Ingenuity, Trust & Thoughtfulness.

External Asset Manager

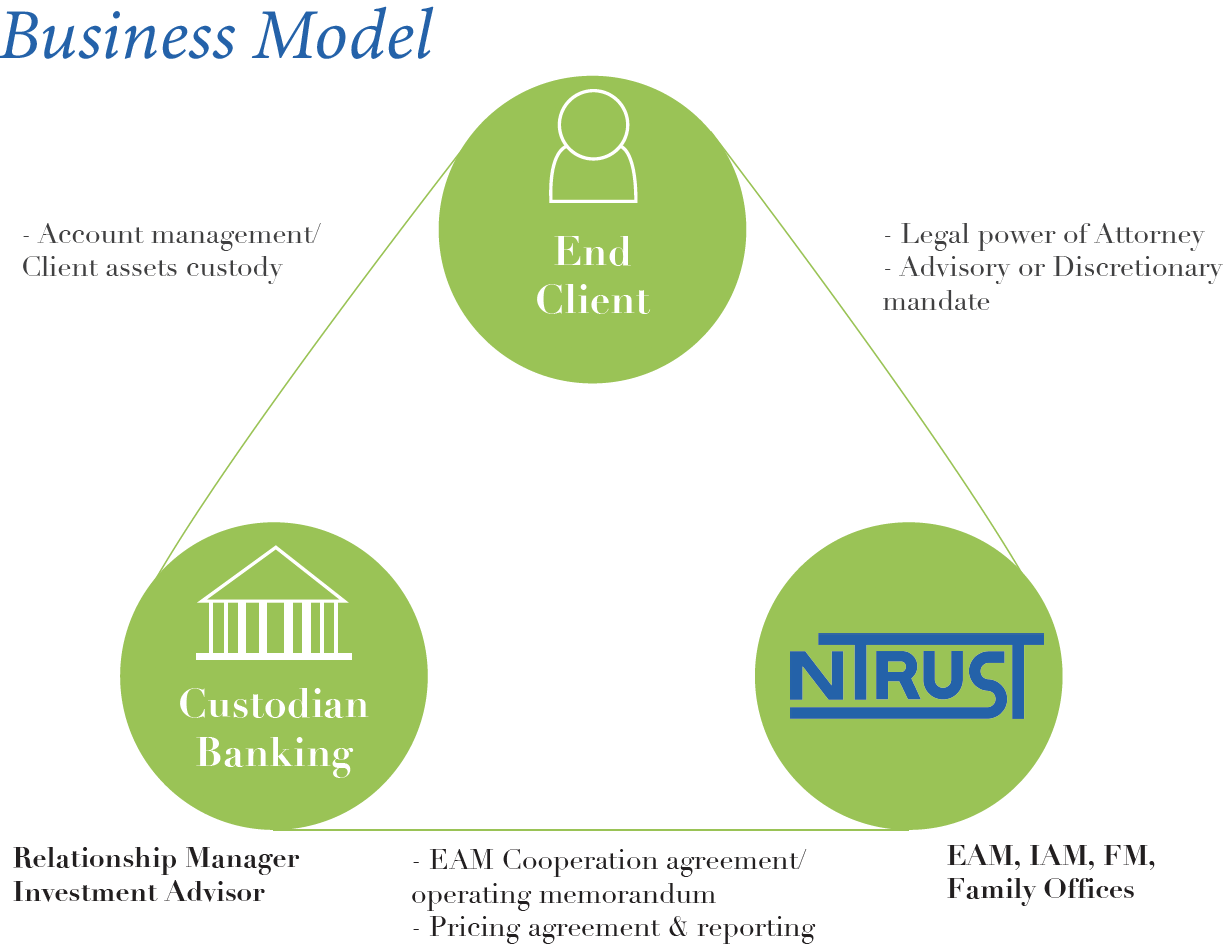

EAM involves a client opening an account with a custodian bank, which maybe a private bank, and placing assets in the account. The client gives the EAM authority and power of attorney as a third Party to represent them in managing the investment portfolio and asset allocations. At all times, the assets remain in an account in the client’s name, but the EAM makes decisions on how the asset should be managed. Such a structure enables us to offer personalized advice catered to our customers’ interests. Our access to several institution platforms allows us to provide customers with the best pricing and offer high security for the custody of their assets.

Product Offerings

Investment and Wealth Advisory

Ntrust offers a wide range of Investment & Wealth Advisory services to their clients. We have tied up with leading international private banks, and offer the entire gamut of wealth solutions that a large private bank can offer. Apart from this, we also offer discretionary portfolio management for private clients and Asset Management for institutional clients.

Discretionary Investment / Portfolio Management

At Ntrust, the team with combined experience of more than 75 years in Investment / Private / Corporate Banking across Emerging Markets we work closely with clients to identify their needs, risk tolerance and accordingly provide a suitable investment portfolio which suits the client’s preference towards risk and investment objectives.

With our diversified experience we manage client’s portfolio with different asset classes.

Fixed Income & Money Markets

Commodities

Listed Equities

Real Estate

Delta Neutral Investment Strategy

Ntrust offers a unique Delta Neutral Strategy that endeavors to profit from the fluctuations in the markets. The main objective of the strategy is to return consistent alpha and absolute returns irrespective of the performance of the underlying market.

The strategy does so by buying a combination of puts and calls in specific ratios at different strikes in order to benefit investors whether the underlying security moves up or down.

Key Features

Client ‘s Hurdle rate of return 8% P.A.

No upfront fee or any other fee till 8% P.A. Over and above 8%, clients get 40% of that.

It’s a perfect hedge against fixed income portfolio.

Structure

Client will open an account through a link sent by Ntrust with Interactive Broker.

Client will have a personal user ID and login password which will allow them to have full access to their account and they can top up or withdraw money at any given time.

Corporate and Private Equity Advisory

At Ntrust we are able to offer Debt / Capital Advisory and/or Private Equity to our clients based on our multi-faceted experience covering various markets and verticals.